It may be best to try a new form that companies Corus's access to markets, CSN's access to raw materials and Tata's managerial capability. But would all the managers be ready to give up personal gains for this option? This remains to be seen as the story onfolds.

An alternate and irreverent perspective on financial markets covering news and analysis for mergers and acquisitions.

Thursday, December 14, 2006

Tata Corus CSN - Three way Deal?

It may be best to try a new form that companies Corus's access to markets, CSN's access to raw materials and Tata's managerial capability. But would all the managers be ready to give up personal gains for this option? This remains to be seen as the story onfolds.

Wednesday, December 06, 2006

This week at ISB...

It started with the Capital Markets Conference on the 29th followed by the ISB Leadership Summit on the 2nd of Dec and then the two day GLS. Each of these events were special in their own rights and have been clubbed with the five year celebrations of the ISB.

We are not sure where we may be another 10 years from now but know where we want to be and the promise is worth the wait. But hope is to be a part of that promise than just a spectator.

It is very easy to get disillusioned by what happens at ISB. So you need to keep you feet firmly planted in the reality and work towards what you want the most. The idea is to prioritize they say.

Saturday, November 04, 2006

P.C. on microfinance

Saturday, October 28, 2006

Placements Ahoy!

I plan to apply to a few as I find the roles interesting although that has nothing to do with my prior experience. The challenge would be to display skills that I can transfer to the open positions.

CAS has promised a lot of fireworks in the coming few months and indicated that this year's the recruitments are going to be our best yet

Me!! I am keeping my fingers crossed.

Wednesday, October 25, 2006

The topology of apology

However in corporate settings, it has other complexities. Some of the complexities arise bacause managers sometimes have to apologise for sins committed by their predecessors or by oversight of others. Other complications exist because doing so may not be in the best interests of the company, at least in the short run and since most managers' incentives are tied to short run performance it becomes an even ardous task.

Then again, there is a problem of how your apology is perceived. It is equally important that the company is perceived correclty and the wording and timing of the apology are appropriate. Lastly, the companies also must match the words they say through their actions.

Tuesday, October 24, 2006

V

Thursday, October 19, 2006

Terrorism and Index of Political Freedom

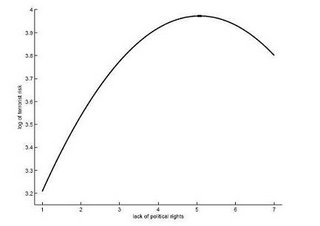

Globally, people tend to view poverty and deprivation as a cause of terrorism. However, in a research, conducted by Alberto Abadie at the John F Kennedy School of Government (Harvard University), factors such as GDP per capita, Human Development Index (HDI) and the Gini Index were found to be non-significant predictors of level of terrorism in countries around the globe.

In the study, Abadie used regression for measuring terrorism as measured by World Market Research Center's Global Terrorism Index (WMRC-GTI) upon various indicators of poverty including GDP per capita, HDI (measure of development in terms of health, education and income) , the Gini Index (measure of income or consumption inequality), Freedom House's Political Rights Index (Freedom House, 2004) , certain geopolitical features including include measures of country land area, average elevation, fraction of the country area in tropical climate and landlock and Indices for linguistic, ethnic, and religious fractionalization which measures the probability that two individuals chosen at random from the same country belong to different linguistic, ethnic, or religious groups.

The data suggests that the dependence on GDP per capita, HDI or the Gini index is not statistically significant and fails to explain terrorism differences. However the other variables including differences in linguistics, geography and climate and lack of political rights are significantly related to the incidence of terrorism.

The study, however, suggests that political freedom has a non-monotonic effect on terrorism i.e. terrorism does not rise with more oppression of freedom but is maximum in the intermediate range (E.g., Iraq, which is making a transition from an authoritarian regime to one with more political freedom is witnessing increased amounts of terrorism and North Korea, which has one of the most oppressive regimes in the world, has the lowest levels of terrorism as indicated by the WMRC Global Terrorism Index (2003-2004)

Also, certain geographical areas have been attributed to cause failure to eliminate terrorism such as mountain terrains (Afghanistan) or tropical jungles (Columbia).

Figure 1 Terrorism and Political Freedom (1- Politically Free to 7 - Authoritarian)

Reference:

Poverty, Political Freedom, and the Roots of Terrorism, Alberto Abadie, October 2004

Wednesday, October 18, 2006

Hierarchical Human Development Index (HHDI): Search for a better index

There is a multitude of indicators that quantify human progress on economic and social development. But what makes a person developed? Yes for the vast majority of people, getting the basic necessities of life, food, shelter and clothing is an everyday struggle. Once a persons basic needs are taken care of, is he content in mere sustenance. Can we call him developed?

If we say that a true measure of development is happiness, what is the index that measures true development of people? Until we develop happiness meters to measure happiness, we have to keep looking for better indicators that measure development.

One way of thinking about and happiness and development is in terms of evolution of needs. As a person evolves, his focus shifts to a new level of needs. If we consider Maslow’s hierarchy of needs to be absolute (although there is no proof of that) how would we want to measure our progress? For some one in search of Actualization, how good is to force him or her to think about basic material needs. Every excess is limited by the law of diminishing returns. Having one common measure of development index is like forcing everyone to keep thinking about needs that he or she derives only a marginal benefit from.

Countries, just like individuals, differ in their focus based on the level of collective development. After having achieved a level, they may want to focus on another set of needs to satisfy. Although, HDI indicator in its present from is a powerful tool for countries to measure their development on the bottom level and there is no doubt that there is a pressing need for them to do so, it has limited significance to top one third of the countries. Why not have different levels of HDI for countries on different levels. This index, called HDDI, would retain the advantages of the current HDI, and would give the relatively advanced societies a handle on their development based on their current level. Countries would be rated on the level they are and compared to countries at the same level. Measures such as environmental protection, political freedom, and gender and secularity issues can be built into appropriate levels. Also, the level of a country can be used to decide upon its responsibilities on each of these levels and those below it. The goal of the nations would be to move up in the hierarchy and then move forward in its level until they reach a new level.

Such an index should take care of the concerns of most nations and possibly give them relevant measures to focus on.

Saturday, September 16, 2006

Wednesday, September 13, 2006

Paper Presentation

Hope to do at least a few more before the course ends ,provided I can afford some time. This effort meant that I slept less than four hours every night over the past 3-4 days. Hope to catch some sleep now on the weekend.

Or maybe not...

Thursday, September 07, 2006

Skill and Resume Verification by NASSCOM?

Efficient Markets or A Random Walk

Are markets efficient or a random walk?

If Current Price = PV of future cash flows for each share discounted at cost of equity and if stock prices change everyday than does cost of equity change everyday or cash flows change everyday ?

Is CAPM the right model for measuring the cost of equity for efficient markets or just a tool for efficient markets.? Does Cost of Equity determing P/E of stocks ? What about Sectoral effects?

Why do stock prices change every day? Is that so because of buying and selling?

If Behavioural effects determine stock prices how does it change every day?

If marakets are efficient than markets should move only on events, but what are these events? How many events take place each day? What are these events?

How do markets discount/price these events?

If large institutional investors use market models, how do they restimate risk everyday? Do they even use these models.

What causes market in efficiency?

Transaction Costs ?

Information Assymetry?

How Soon do people with information exploit this assymetry?

Minimum Tick Size?

Currency Risks?

What about trends? Bollinger Bands, Inverted Heads and shoulders, cups and handle , break outs? How come do market technical analysts make a living?

What about irrational exhuberence?

So how efficient are markets anyway? Perfectly efficient or Varyingly efficient?

Monday, August 28, 2006

My Kinda' ATM

Sunday, August 27, 2006

Term 3 Exams

Saturday, August 26, 2006

Six Degrees of Separation

Consider this, I was able to link back to my brother, whom I had not added as a friend, through my group mates here at ISB. Even most of my other friends from school are connected through at least one of my group mates here. Just wondering, would this have been possible before the advent of the internet. And I haven't had to go beyond 3 intermdiaries yet.

Thursday, August 24, 2006

No ELP :(

Term III exams are next week. Between today and 3-4 weeks later, need to figure out what stream would I be majoring in, as the bidding for electives starts 3 weeks into the fourth term. Would need to do some serious thinking on the matter. Its been too long waiting for enlightenment ;).

Thursday, August 17, 2006

Consulting or not to be?

They plan to conduct a few more follow up sessions, apparently to help the students prepare for the placement week. However, it may have more to do with identifying the right people early on. Anyways, nobody's complaining, considering they can hardly afford to make, what they call recruitment mistakes and students benefit too. Some of the students turned out in suits. Reminded me of the MIB recruitment line,''... Best of the best of the best", for those who have seen the movie. Although the presenters themselves were dressed more in business casuals. But, I think they flew in to hyderabad, after a full work day.

It has been a long day and I must get some long deserved sleep now. Alas! There are three more assignments due for Monday morning.

Wednesday, August 16, 2006

Disruptive Technologies! Myth or reality?

Monday, August 07, 2006

The hottest hand in Silicon Valley

Founding companies

Sun Microsystems Inc.

Daisy Systems

i-Ram Systems Inc.

Khosla Ventures

Helping to found companies

NexGen (now purchased by AMD)

Excite

@Home Network

Juniper Networks

Cerent

Corvis

Well, if you still do not know who I am talking about, then read this. Saw an old video of him of a session he conducted at ISB. Could not help being impressed. He certainly knows what he talks about.

Anyways, every year ISB plays host to TiE-ISB connect every year and if you are wondering what is this TiE I am talking about, then look here or here.

Our man has been one of the speakers at this event in the past.

Well, if you are even remotely thinking about enterpreneurship then you have got to be here at ISB for the TiE-ISB Connect.

Sunday, August 06, 2006

ISB Applicants - Query Section

So if you need any info or advice just shoot your questions.

Friday, August 04, 2006

Would I Bite The Bullet? Rather, Would They?

Now, I come from a similar pedigree myself, having worked at a tech company for a considerable period. This conflict between managers and engineers would always be there in such a company. Should they value their engineers more than the engineers or vice versa. An engineer would say that they are the real bread winners of the corporation and without them the company would collapse and Managers would feel the same way about themselves, but would probably not say tell this to the engineers.

Truth, for a technical firm, would be a combination of both. Fact is that without technical talent corporation would suffer and would suffer too, without good managers.

Sunday, July 30, 2006

Blogs are like opinions, every one has them !?

Well, my post is not about that It is rather about blogs. A lot of people vent out their feelings on the blogs. A lot of that can be compared to the situation above. While, it is any day better than not having any opinion voicing at all, but the readers must read these blogs in that context and be aware that a lot of what is being propagated through these blogs are actually personal opinions and looked at in that perspective while forming your own conclusions. With the increasing power of blogs to influence opinion these days this assumes greater importance.

This is not to say that blogs have no utility. On the contrary, I feel that blogs have the power to become a huge tool for empowering the general public. But they should become more than the topic of this post

Friday, July 21, 2006

We, the Voyeur!

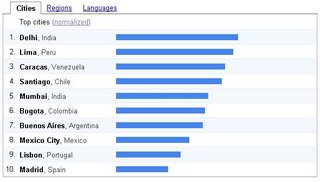

The above picture refers to the the search volumes in differrent cities, all over the world, for ''Pamela Anderson''. Once again saddi dilli manages to top the list. Amchi Mumbai comes in a close 5th. (For the current scores click here). Need, I say more. Google does not give exact figures so we cannot comment on the relative figures, ratios, per capita searches for 'Pamela' from this trend but the big picture still remains true. Long live C.J. Parket

Tuesday, July 18, 2006

Death and Taxes!

"The two most common elements in the universe are Hydrogen and stupidity."

Wednesday, July 12, 2006

Honor Code

Sunday, July 09, 2006

TiE-ISB Connect 06 - Sculpting Ideas, Building Businesses

The TiE – ISB Connect 06 is scheduled at the ISB during September 20-22, 2006. This year we have significantly up-scaled the scope and magnitude of the event, with discussion tracks on diverse sectors including Internet & IT Services, Bio-Pharma, Media and entertainment, Infrastructure/ Real Estate, Telecom/ Wireless, Semiconductor, and Retail. Each track will have a keynote address by a successful entrepreneur, a review of global trends in the sector by an analyst, and a panel discussion by venture capitalists and successful entrepreneurs on sector opportunities. Entrepreneurs seeking opportunities in these sectors may attend the event as delegates.

The entrepreneur community can also benefit from three specific opportunities: Investor Pitch (Presenting plans to potential investors); Venture Showcase (Exhibiting product/ service) ; Jumpstart your venture (Workshop preparing the aspiring entrepreneur for an exciting journey)

For further details, please visit www.tie-isbconnect.com

3.23 billion to watch the world cup finals!!??

I believe the 3.23 billion, in theory, to be the population of countries/regions where these matches would be aired live.

Wednesday, July 05, 2006

Online Search Trend for 'ISB'

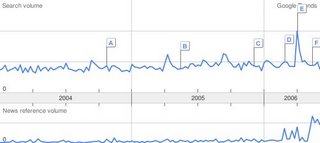

The picture on the left shows the trend for online search volume for "ISB" and in the lower part shows how often the word "ISB" was referenced in online news.

Two trends are clearly visible. There was a huge surge around 'E', early april that an ISB student had bagged a 1 crore salary. On the news reference trend, onve can see the trend line really taking off after the Bush Visit and continued to rise higher with announcements of placement results and even higher with announcements of profile of batch of 2007 (Marked 'F' ).

The two events have generated massive publicity and good PR for the Indian School of Business.

Picture Source Google Trends

Saturday, June 24, 2006

Saturday, June 17, 2006

How Bernanke's utterings affect the Sensex

Though Indian markets as well as the other emerging markets have been responding in a positive way to the growh in the economy, their meteoric rise has been fuelled by the supply of FDI.

The rate of inflation is related to the supply of money in the market. With oil prices touching new highs, there is a real danger of inflation affecting people all over the world. One of the ways to keep inflation in check is by reducing the liquidity in the market ie reducing the flow of cash or easy money in the market. One of the ways of doing this is by increasing the interest rates on all lending.

This has a two fold effect. One, it reduced the amount of cash people are willing to borrow from banks to invest else where it also increased the amount of money going into fixed deposits and loans. Also, incurring new debt becomes expensive for corporations and they decrease their spending and hence growth. All of there have contributed to the outflow of hotmoney from the market leading to the crash that happened.

Now with BB, under playing the fears of inflation, it is hoped that there would be no futher increase in the nominal interest rates and we might see a resurgence of funds into emerging markets. This is what we may have seen during the last couple of days.

Also the fact that we bounced off the support level of 8800 we have may a stronger case for markets to gain some strength.

There have been some predictions of markets (BSE sensex) going up to 18000 in the next 2-3 years but for that cetiris peribus India would have to maintain its growth rate. of above 7 to 8 percent.

Leaders we deserve!

Wednesday, June 14, 2006

Sensex Support

Sunday, June 11, 2006

Life is good... @ISB

Any how, we probably could do with some strategic skimming of the course. Ironically competitive strategy is one of the courses on offer in term -2 (probably should have been part of the first term, to help us all prepare for the grind ahead). Not that we need to be more competitive. The junta here is as competitive as can be but we surely could use some strategizing for the exams and on how to tackle.

That said, I did manage to skim through the introductions to all the four courses and am really excited about it. Besides comp., strategy we have macro eco.. (aka global economics), marketing and decision making (or Mark II as knows in US schools) and decision models and optimization. The faculty is great (atleast on paper). After putting up a decent show in the first, would need to get my 'A' (all puns intended) game in this term.

Amidst all the partying and playing in this break, did manage to catch a glimpse of the city, courtesy one of the local students. The weather has been excellent all this while so absolutely no excuse to complain.

Life is good...

Monday, June 05, 2006

Term I at ISB - almost over!!

I think the best thing about ISB, is that we have 4 exams in 2 days flat. You can clear most if you are attentive in class and follow up on your assignments. This also means that there is greater focus on learning and understanding rather than expecting students to mug up and puke stuff out on the day of the exam.

Okay, before I get carried away, I still have 2 exams tomorrow. So Chao....

Thursday, June 01, 2006

Technical Support Levels for Nifty

Besides the support for Nifty at 2896.4, the index also has support level at around 2840 to 2850 levels. Below that level, it may go into a free fall all the way down to 2670

Fundamentally the market seems ripe for cherry picking, but the news flow and technicals are just dragging the market down. Buyers would jumpe in at any fresh signs of consolidation.

Wednesday, May 24, 2006

Bloggers List - ISB@2007

Abhishek Jain

Alok Jain

Anuradha Sunku

Archana Rao

Arun Dhar

Chiranth Chanappa

Deepak Mittal

Disha Rustogi

Kapil Mantri

Karthik Bharathy

Kiran Cavale

Kishore Krishna

Krishnan Ramaswami

Kumar Rajendran

Mahesh Shenoy

Manu Karan

Nikhil Kamma

Nikhil Kaushik

Piyush Kheria

Pratima Jayaram

Priyanka Rath

Rishik Ghosh

Rujuta

Sabyasachi Mohanty

Santosh BS

Satish Udayagiri

Sharad Mittal

Shivangi Tiwari

Sowmya Velayudham

Sukalp Sharma

Sumit Poddar

Sundeep Tibrewal

Swapnil Deopurkar

Swapnil Nadkar

Venkat Raman

Vinay Pandey

Vithal Donakonda

Yashovardhan Gupta

And of-course yours truly.

This has been taken from Ram's blog

Monday, May 22, 2006

One more crash !! Support at 10250 still intact

Dynamics of Learning

This seems to be a pattern in my life. (at-least academically) It seems, I only get things right or get a deeper understanding if I re-read a second time. Maybe I work things out in my sleep. Talk about tapping the latent power of the mind.

Anyways, the mid term exams (here at ISB) were on last Friday. So after a couple of days of partying and catching up on sleep, people are back in full swing to studying. There weren't too many takers for the soap box presentation for two posts of directors for student body. Tomorrow promises to be more exciting with the position of PlaCom director at stake. There is one clear favourite, but maybe some black horse can win the race at the last minute. Would take some running on his or her part though.

With that, I think its time to go back to the assignments.

PS: If you like the header/title hack, you can find it here and here

Saturday, May 20, 2006

Reservations: Food for though !

Would you want someone to vote operate on you or your loved ones, after knowing that they made it to medical school because they belonged to a special category of people and not on merit?

Would you trust an airline that got its planes designed by some one who made it there because of similar reasons a above?

Would you send someone to fight for you and trust them to defend you when he or she came from some special quota and not on the ability to defend you?

You dont get someone to represent you at the olympics, just because he came from a special group and is not our best athelete?

Hell, you dont have reservation in the Indian Cricket team. Would you let someone change that?

Do you still believe in legislation for quotas in the private industry or that matter government jobs?

Friday, May 19, 2006

Sensex Support Levels

Sensex - has support at 10750 levels

below this there is support only at 10250.

After mid-terms, its time again to party at ISB.

Tuesday, May 09, 2006

Micro Finance Institutes: The lesser evil?

Saturday, May 06, 2006

Assignments- at ISB

Bloggers at ISB

1. I am lazy.

2. Too little time.

3. I would like to and have some thoughts that I want to put down but do not do so because either I do not want to share them or may not think that it adds value to any reader in any particular way. Cause, whether you agree or not you do at times want to be read but sometime you are split right in the middle.

The blogs that I want to go back and read do not necessarily have the most valid point but also articulate them really very well. So hopefully when I am thinking aloud, rather in this case I am just writing what I am thinking, I would make some sense and not just ramble incoherently.

That said, quite a few people here at ISB are frequent bloggers. A couple of them really write well. Others, like me .. Well I'd just leave that to the reader.

Wednesday, April 26, 2006

The race has begun?

However, the truth is that we are all here to make something out of the the one year at ISB. People have decided upon their course of action. Some just want to study, others just want to make friends and network, others are sharing knowledge and are trying to prove themselves as eager, yet capable club presidents.

For some the end goal is important while others want to soak in the journey.

For me, I hope, it is the middle path leaning towards the latter.

Saturday, April 22, 2006

Trauma Transforms!!!

I was shortlisted for TAS (Tata Administrative Services) and although I was really looking forward to this I have decided not to go to mumbai for the final interview round.

We have a saying here at ISB. "Trauma Transforms". To what? is the question....